Finding an efficient accounting solution for e-commerce can be a daunting task, yet it’s essential for the success of any online business. Synder emerges as a promising contender in this domain—boasting a suite of features designed to cater to the diverse financial needs of digital marketplaces. This review will explore the nuances of Synder pricing, the flexibility of Synder subscriptions and plans, and how the integration capabilities of Synder enhance e-commerce operations.

Recognizing the importance of accessible financial tools, Synder offers a range of subscriptions that promises to align with businesses of all scales. Whether a business processes 500 or over 50,000 transactions monthly, there is a Synder plan tailored to meet those requirements. The commitment to providing an inclusive structure for e-commerce is also echoed in the availability of Synder features and integrations with popular accounting platforms. Moreover, businesses can maximize their investment through Synder discounts, especially with structured savings for annual billing cycles.

Integrating Synder into an e-commerce setup is simplified with comprehensive Synder tutorials, ensuring that users can harness the full potential of the software to streamline their finances. With its focus on seamless reconciliation and intelligent automation, Synder sets itself apart as a robust tool for businesses looking to solidify their e-commerce ventures. As such, this review intends to dissect each aspect of Synder’s offerings to provide clear insights into its value proposition.

Key Takeaways

- Synder offers a variety of plans to match transaction volumes of different-sized e-commerce businesses.

- Yearly subscriptions come with considerable discounts, making Synder a cost-effective solution.

- The integration capabilities with accounting platforms like QuickBooks and Xero make Synder a versatile choice for e-commerce.

- Comprehensive features within Synder’s ecosystem cater to in-depth financial reconciliation needs.

- Structured partner programs with Synder can lead to added benefits and discounts for multiple clients.

- Content-rich tutorials ensure that businesses can capitalize on Synder’s features with ease.

Understanding Synder: An Overview of Features and Integrations

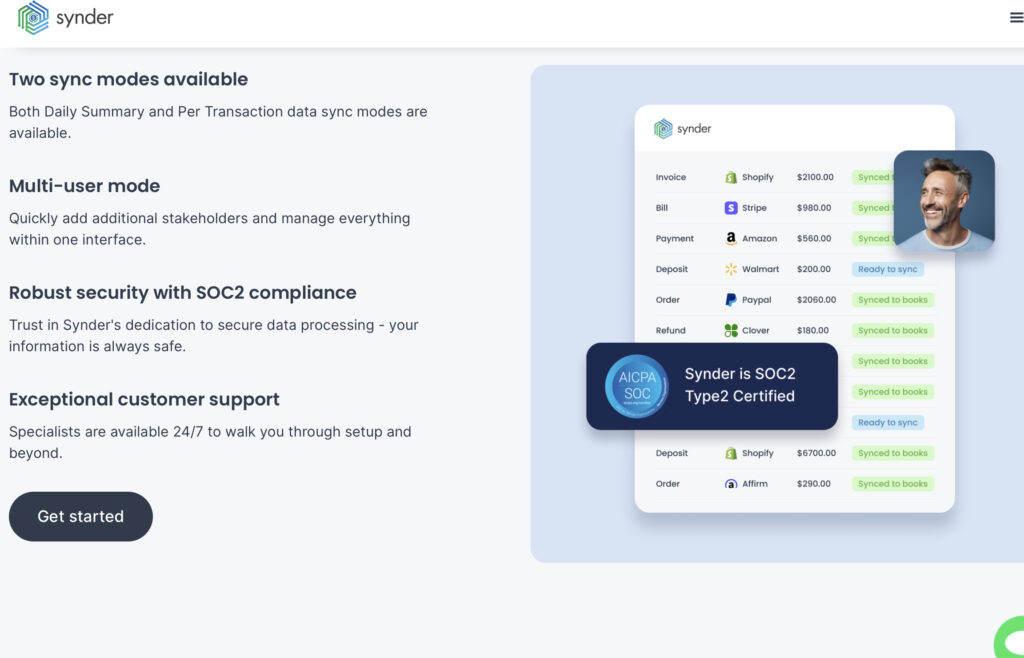

As the digital commerce landscape evolves, Synder stands out as a pivotal solution for e-commerce businesses seeking to streamline their financial processes. By offering robust Synder features such as automated allocation, instant transaction sync, and multicurrency support, the platform not only simplifies but also accelerates the day-to-day operations of online merchants.

Synder’s Key Features and Functionalities

At its core, Synder addresses critical needs with a set of powerful features tailored for e-commerce efficiency. Notably, its smart rules for transaction modification enhance operational flexibility, while one-click reconciliation ensures financial accuracy without unnecessary delays. In particular, the instant transaction sync feature enables real-time updates to user’s accounting systems, reflecting the dynamic pace of online transactions.

Seamless Integration with Accounting Platforms

Recognizing the heterogeneity within the accounting software market, Synder has developed seamless Sander integration capabilities. Supporting an array of platforms including QuickBooks Online, QuickBooks Desktop, Xero, and Sage Intacct, Synder’s integrations are designed to be both inclusive and user-friendly, accommodating various business preferences and requirements.

Synder’s Role in Reconciliation and Reporting

When it comes to financial visibility, Synder excels in its role in reconciliation and reporting. The software’s automated allocation cuts down manual labor, providing accurate and timely financial insights—a lifeline for decision-makers in a competitive e-commerce environment. Furthermore, its comprehensive multicurrency support broadens the operational capacity of businesses engaging in international commerce.

| Feature | Description | Benefits |

|---|---|---|

| Automated Allocation | Artificial intelligence-based categorization of financial transactions. | Enhances accuracy and saves time. |

| Instant Transaction Sync | Real-time update of transactions in the accounting systems. | Ensures up-to-the-minute financial data. |

| Multicurrency Support | Compatibility with multiple currencies for international transactions. | Facilitates global commerce and financial management. |

Synder Plans Explored: From Single User to Enterprise Needs

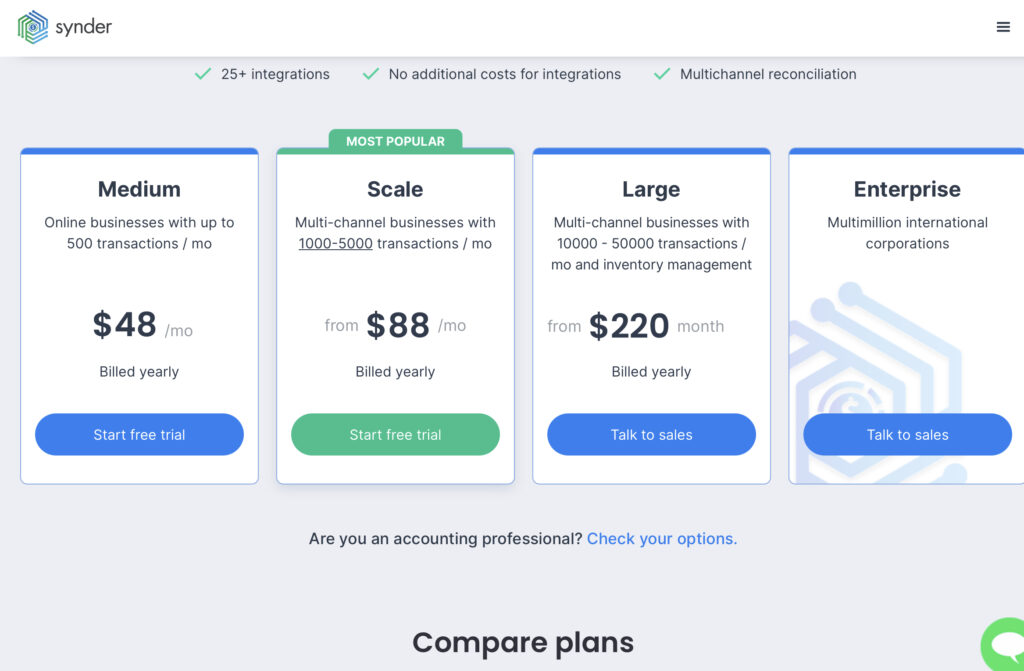

Designed to streamline the financial workflows of modern multichannel businesses, Synder subscription plans offer a robust yet adaptable solution for individual proprietors and substantial enterprise accounting solutions alike. Recognizing the diversity in transaction volume flexibility, Synder has developed a series of plans to accommodate online businesses of varying complexities and demands.

Each tier of Synder plans acknowledges not only the number of monthly transactions but also the depth of functionality necessary for thorough financial management. Below is an illustrative breakdown of their subscription plans:

| Plan Type | Transactions Per Month | Best Suited For | Key Features |

|---|---|---|---|

| Medium | Up to 500 | Small online vendors | Core accounting features, fundamental insight reports |

| Scale | 1,000-5,000 | Growing online markets | Enhanced transaction handling, personalized support |

| Large | 10,000-50,000 | Established e-commerce platforms | Comprehensive transaction analysis, user access management |

| Enterprise | 50,000+ | Large-scale operations | Inventory management, commerceAPI, dedicated servers |

For entrepreneurs and business owners, the ‘Medium’ and ‘Scale’ plans offer the essentials for managing sales and expenses, while high volume merchants will find the ‘Large’ and ‘Enterprise’ plans better suited to their robust transaction handling needs. Synder provides the scalability required to grow seamlessly, thereby supporting merchants as their businesses expand.

In response to the increasing demand for customized and flexible enterprise solutions, the ‘Enterprise’ plan includes specialized tools like individual transaction processing servers and commerceAPI – promising to enhance efficiency for businesses facing high transaction volumes and complicated accounting requirements.

As businesses evolve, the necessity for accounting software that can meet the demands of significant transaction growth becomes imperative. Synder’s structured subscriptions boast the adaptability and technical resources necessary to manage financial data accurately and efficiently.

Synder Pricing Unveiled: Decoding Plans, Subscriptions, and Value

When evaluating the best e-commerce accounting solution, transparency in pricing is vital. Synder offers its users competitive and flexible pricing options, catering to a diverse range of business needs. Understanding the nuances between monthly and annual billing, as well as the lucrative discounts available through partner programs, is crucial for businesses looking to optimize their accounting processes with Synder.

Comparing Synder Pricing: Monthly vs. Annual Subscriptions

In the world of e-commerce accounting, Synder’s pricing structure accommodates both short-term and long-term financial planning. The choice between monthly vs. annual billing can significantly impact the overall synder pricing, with substantial savings available for those who commit annually.

| Plan | Monthly Billing | Annual Billing | Annual Savings |

|---|---|---|---|

| Medium | $61 | $48 | $156 |

Exclusive Discounts and Bonuses for Partner Programs

For professional accountants and bookkeepers, Synder’s partner programs provide a tiered discount system, encouraging growth and scalability within their practices. Partners can expect reduced synder pricing and additional bonuses, creating a mutually beneficial relationship.

- Up to 20% off for partners with 15+ clients

- Biannual bonuses

- Exclusive marketing campaign access

Assessing the True Value: Is Synder Right for Your E-commerce?

It is imperative for businesses to ascertain the value an accounting solution like Synder provides. With its adept handling of multichannel financial transactions, thorough Synder review testimonials, and the promise of Synder discounts for strategic partnerships, businesses can secure an essential tool for their e-commerce needs.

Ultimately, the pricing plans should be considered in tandem with the suite of features and the unparalleled support offered, ensuring that businesses make an empowered choice with regards to their e-commerce accounting solutions.

Maximizing Business Potential with Synder Features for E-Commerce

E-commerce businesses seeking to streamline their financial processes will undoubtedly benefit from the robust features offered by Synder for e-commerce. By enhancing transaction management and providing advanced tools for inventory tracking and tax tracking, Synder stands out as an innovative solution. Its application of smart rules simplifies the complexity of financial operations, while comprehensive reviews have shown that users experience a marked improvement in efficiency when employing Synder’s system.

One of the key aspects where Synder shines is in its inventory tracking capabilities, which ensure real-time updates to stock levels, essential for maintaining accurate inventory counts. Such precision significantly reduces the risk of overselling and ensures that businesses can swiftly respond to stock discrepancies. Moreover, tax tracking prevents the headache of sales tax computations, offering e-commerce businesses a much-needed respite from complex tax regulations and compliance issues.

Smart rules functionality in Synder allows businesses to automate the modification of transactions, ensuring that each entry is categorized and recorded correctly. This level of automation is crucial for businesses looking to scale without exponentially increasing their workload. With the integration of smart rules, Synder helps businesses establish consistent and reliable financial records, essential for both short-term operations and long-term growth strategies.

The table below showcases how Synder’s features contribute to the essential financial management tasks needed by e-commerce businesses:

| Feature | Description | Benefits |

|---|---|---|

| Inventory Tracking | Adjusts stock levels in real-time. | Accurate stock management and reduced overselling risk. |

| Tax Tracking | Simplifies sales tax management for various regions. | Ensures tax compliance and reduces manual tax calculations. |

| COGS Synchronization | Tracks daily summaries of products costs and quantities. | Improved insight into profitability and inventory valuation. |

| Smart Rules | Automates transaction classification and recording. | Enhanced data accuracy and time-saving on transaction management. |

With its comprehensive e-commerce features, Synder provides an all-encompassing platform that not only manages but also propels businesses forward. In-depth Synder reviews have attested to the platform’s efficacy in reconciling accounts, tracking financial data, and managing numerous other aspects critical to e-commerce success. It’s this meticulous attention to the needs of e-commerce that has put Synder at the forefront of financial management solutions.

Final Recommendations

Synder is an invaluable tool for e-commerce businesses looking to streamline their financial management. Its powerful features, including automated transaction recording, real-time insights, and seamless integration with leading e-commerce platforms and accounting software, make it a must-have for any online retailer.

If you’re serious about taking control of your finances and saving time on tedious accounting tasks, we highly recommend giving Synder a try. With flexible pricing plans and a user-friendly interface, it’s an investment that’s sure to pay off in the long run. Don’t miss out on the opportunity to transform your financial management with Synder. Sign up for a free trial or explore their subscription options today and take the first step towards hassle-free accounting for your e-commerce business.

Conclusion

In the dynamic realm of e-commerce, Synder has carved out a name for itself as a potent e-commerce accounting solution, catering to businesses small and large with its scalable subscriptions. Through this detailed synder review, we observe how the platform simplifies and automates crucial aspects of financial reconciliation with precision. Flexibility is a key strength, as seen in Synder’s varied plans, which offer transaction management solutions for enterprises of all transaction volumes. The platform’s robust feature set enhances its position in the market, delivering substantial Synder benefits to the end-users.

Moreover, the platform’s integration prowess offers users uninterrupted connectivity with leading accounting software, enabling a seamless transaction flow. With Synder’s subscriptions, businesses gain not just an accounting tool but a comprehensive financial centerpiece that aligns with diverse operational scales and e-commerce demands. The touchstone of Synder’s ethos lies in its customer-centric approach—manifested in attentive support, nuanced feature development, and a willingness to evolve with the needs of the e-commerce landscape.

Finally, considering the long-term perspective, Synder stands out by offering tangible fiscal advantages to those who opt for annual plans, making it an economically sound choice in the long run. The benefits of partner programs further underline the company’s focus on fostering growth and profitability for its clients. As businesses continue to navigate the complexities of e-commerce financials, Synder emerges as a compelling ally, committed to equipping them with a top-tier reconciliation and accounting solution.